Medium-term Management PlanInvestor Relations

Progress’24—The Kurabo Group’s New Medium-term Management Plan

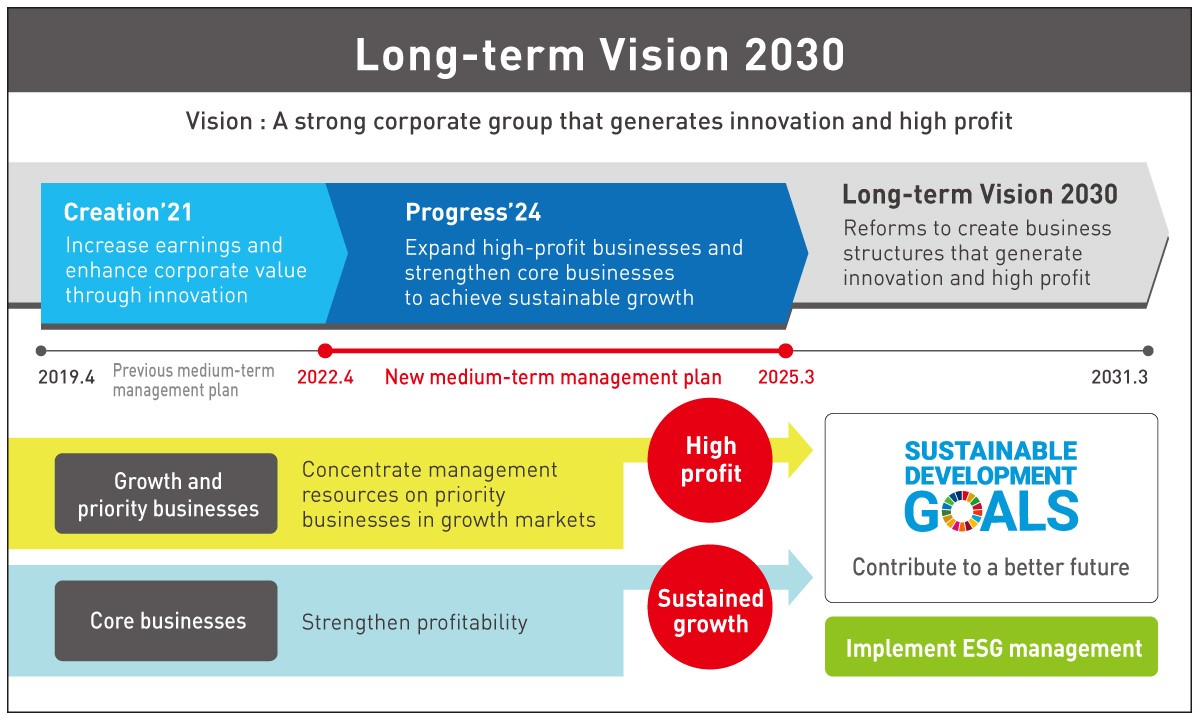

The Kurabo Group has formulated a new three-year medium-term management plan, Progress’24, with the target year of fiscal year 2024, and started it in April 2022.

1. Basic Policy

As the second stage of the Kurabo Group’s Long-term Vision 2030, which seeks to ensure we become a strong corporate group that generates innovation and high profit, Progress’24 is positioned to play a key role: that of getting our plans, which have been delayed due to factors including the COVID-19 pandemic, back on track.

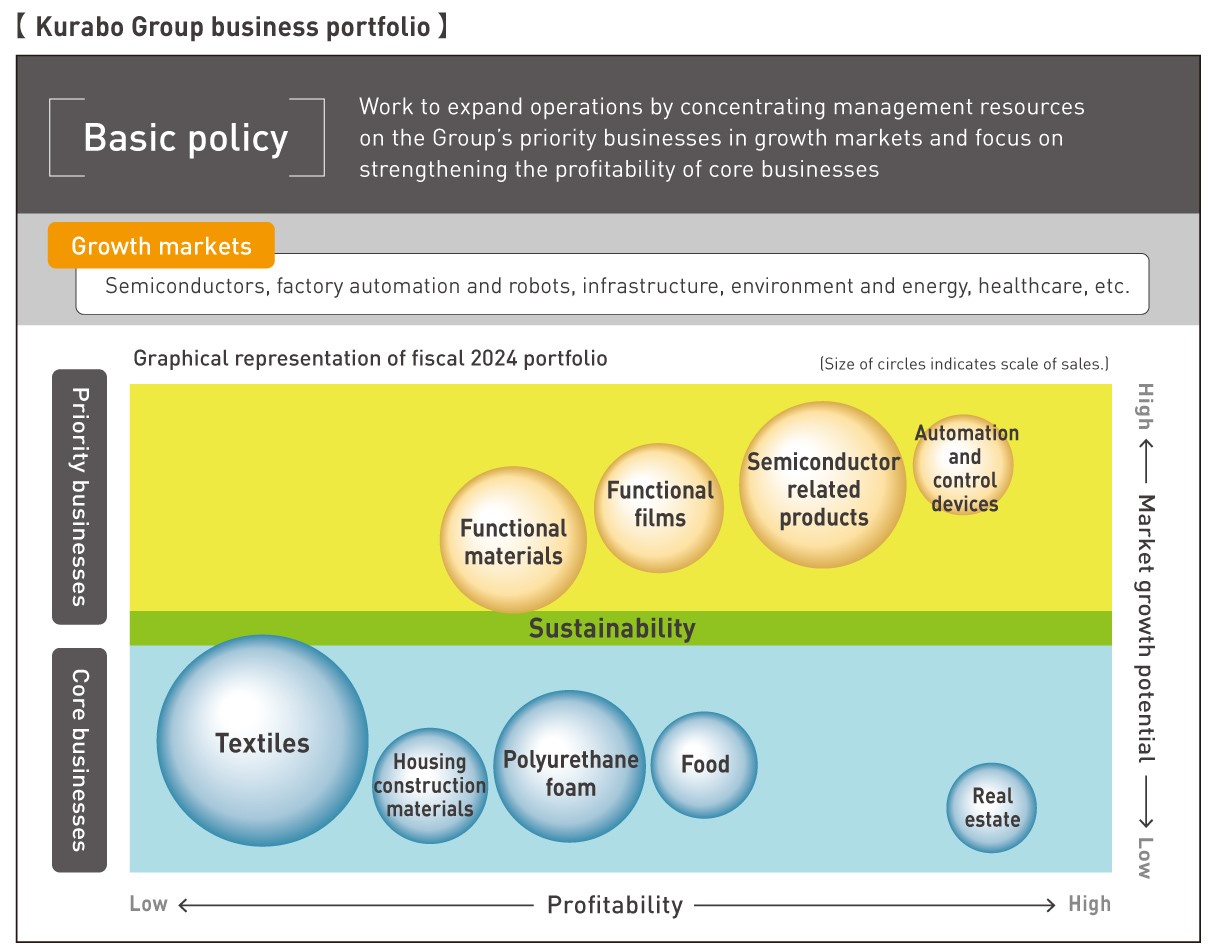

Under Progress’24, our basic policy will be to expand high-profit businesses and strengthen core businesses to achieve sustainable growth. In addition to concentrating management resources on priority businesses in growth markets, we will work to strengthen the profitability of core businesses while building an optimal business portfolio so that we can increase corporate value in a sustained manner, even in a business environment characterized by intense change. In addition, we will both strengthen group governance and pursue management with an awareness of sustainability, for example by working to resolve social issues.

2. Priority Policies

- (1)Expanding growth and priority businesses and strengthening profitability in core businesses

- In keeping with the basic policy underlying the Group’s business portfolio, we will work to expand operations by concentrating management resources on priority businesses such as semiconductor-related products, functional films, automation and control devices, and functional materials. In addition, we will ensure stable profits in core businesses including our textile and polyurethane foam businesses, through increased production efficiency and cost savings, for example by computerizing and strengthening QR capabilities in production operations.

- (2)Creating new businesses by strengthening R&D activities and quickly placing them on a profitable footing

- We will work to create new businesses and quickly place them on a profitable footing by pursuing R&D activities with a focus on factory automation and robot control, semiconductor-related products, functional materials, and gene extraction and analysis in an effort that will be led by our Technical Research Laboratory and our Textile Innovation Center.

- (3)Contributing to the SDGs (Sustainable Development Goals)

- Building on a sustained effort since our founding to improve the labor environment and contribute to the development of the local communities we serve, we have chosen to address Goal 9 (“Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation”), Goal 11 (“Make cities and human settlements inclusive, safe, resilient and sustainable”), and Goal 12 (“Ensure sustainable consumption and production patterns”) as top-priority issues as we strive to fulfill our responsibility as a manufacturer. Going forward, we will focus on achieving those goals.

- (4)Promoting a diverse workforce

- The Kurabo Group has worked to create a corporate culture in which a diverse workforce can make the most of their skills and do their jobs in an autonomous manner by pursuing Diversity, Equity & Inclusion as well as flexible workstyles like flextime and telework. Going forward, we will strive to foster the development of employees who can bring innovation to our businesses in a way that leads to sustained improvement of corporate value and to build an organization characterized by a high level of engagement so that employees can take the initiative to contribute to its operation.

3. Targets

(1)Consolidated performance targets and management indicators

| Fiscal 2021 | Fiscal 2024 | |

|---|---|---|

| Net sales | 132.2billion yen | 160billion yen |

| Operating income | 7.5billion yen | 9.6billion yen |

| Ordinary profit | 8.7billion yen | 10.2billion yen |

| Net income attributable to owners of parent | 5.6billion yen | 7.2billion yen |

| Key management indicators (fiscal 2024) | |

|---|---|

| Sales operating profit ratio | 6.0% |

| ROE (return on equity) | 7.0% |

| ROA (return on assets) | 5.3% |

| ROIC (return on invested capital) | 5.6% |

(2)Performance targets by business segment

| Fiscal 2021 | Fiscal 2024 | Change | ||

|---|---|---|---|---|

| Textiles | Net sales | 44.6billion yen | 54.0billion yen | +9.3billion yen |

| Operating income | ▲0.1billion yen | 0.8billion yen | +0.9billion yen | |

| Chemical Products | Net sales | 51.6billion yen | 63.0billion yen | +11.3billion yen |

| Operating income | 2.9billion yen | 3.9billion yen | +0.9billion yen | |

| Advanced Technology | Net sales | 23.5billion yen | 29.0billion yen | +5.4billion yen |

| Operating income | 2.7billion yen | 3.0billion yen | +0.2billion yen | |

| Food and Services | Net sales | 8.4billion yen | 10.3billion yen | +1.8billion yen |

| Operating income | 0.2billion yen | 0.7billion yen | +0.4billion yen | |

| Real Estate | Net sales | 3.7billion yen | 3.7billion yen | ▲0billion yen |

| Operating income | 2.7billion yen | 2.3billion yen | ▲0.4billion yen | |

| Elimination or company-wide(*) | Operating income | ▲1.0billion yen | ▲1.1billion yen | ▲0billion yen |

| Total | Net sales | 132.2billion yen | 160.0billion yen | +27.7billion yen |

| Operating income | 7.5billion yen | 9.6billion yen | +2.0billion yen | |

(*)The breakdown of “Elimination or company-wide” is mainly for R&D expenditures not attributable to any segment.

(3)Priority policies by business segment

- Textiles

- ・Expansion of sales of high-function materials and sustainable materials that take advantage of proprietary technologies

- ・Improvement of QR capabilities and productivity with an awareness of the entire supply chain

- Chemical Products

- ・Concentration of management resources on priority businesses in semiconductor- and energy-related markets

- ・Streamlining of production structures in core businesses like polyurethane foam and housing construction materials and expansion of new businesses

- Advanced Technology

- ・Establishment of competitive advantages through strengthening of products and sales expansion in overseas markets

- ・Introduction of product groups that help solve social issues

- Food and Services

- ・Food business: Development of freeze-dried products from a customer perspective and sales expansion

- ・Hotel business: Improvement in occupancy of hotel that has carried out large-scale renovations and contributions to local communities

- Real Estate

- ・Redevelopment of rental real estate and early transition to a profitable footing

4. Basic Policy on Investment and Capital

We will work to improve profitability by investing management resources in fields with high growth potential from a medium- and long-term perspective; in IT infrastructure, which will play a core role as we pursue digital transformation (DX); and in the environment, with a view towards realizing carbon neutrality.

We will adopt a proactive and ongoing approach to the investment of management resources, including through M&As, capital investment, R&D, intellectual property, and investments in our workforce.

Capital investment

(cumulative total over 3 fiscal years)

| Growth and priority businesses | 6.5billion yen | |

|---|---|---|

| Environmental investments | 24billion yen | |

| IT investments | 24billion yen | |

| Maintenance, updates, etc. | 69billion yen | |

| Total | 18.2billion yen | |

| Depreciation expenses | 17.5billion yen | |

R&D expenditures

(cumulative total over 3 fiscal years)

| Factory automation and robots | 1.3billion yen | |

|---|---|---|

| Semiconductor-related products | 1.2billion yen | |

| Gene extraction and analysis | 0.5billion yen | |

| Functional materials | 2.9billion yen | |

| Other | 0.1billion yen | |

| Total | 6.2billion yen | |

We will work to leverage intellectual property to expand operations and realize competitive advantages in growth and priority businesses by analyzing, evaluating, and classifying value (for example, in the form of technologies, expertise, and brands) created via R&D and business activities through IP landscape activities and other initiatives and developing associated rights.

Although we consider the stable and ongoing return of profits to be fundamental based on our awareness that shareholder dividends are one of the company’s top-priority issues, we will also consider share buybacks as another way to return profits to shareholders. During the period covered by Progress’24, we will work to enhance such returns by establishing and implementing a payout ratio of at least 50%.

5. Basic Policy on Sustainability

The Kurabo Group believes that in order to contribute to the realization of a sustainable society, it must strive to improve its own corporate value on an ongoing basis. In addition to developing and expanding high-profit businesses by creating high-value-added technologies, products, and services, we will work to implement the following in accordance with our management philosophy: “The Kurabo Group contributes to a better future through the creation of new value.”

- (1)Contributing to the resolution of social issues through our businesses

- (2)Carrying out business activities founded on an awareness of the need to protect the Earth’s environment

- (3)Putting in place a workplace environment characterized by respect for human rights, worker-friendly policies, and an engaging atmosphere

- (4)Working to earn the trust of society and stakeholders

We will also study the approach of the Task Force on Climate-related Financial Disclosures (TCFD) and associated disclosures during the period covered by Progress’24.